Many teens with big business ideas struggle to find the money to get started. Did you know 41% of teen entrepreneurs start with less than $500? The good news is there are many funding options for teen entrepreneurs from simple crowdfunding to special grants.

This article will show you ten ways to get the cash you need to launch your startup.

Quick Facts

- 41% of teen entrepreneurs start with less than $500, so personal savings and family support are the first funding steps.

- SBA Youth Entrepreneurship Program government grants give $5,000 to $25,000 in startup funds without teens having to give up business ownership.

- Angel investors give $25,000 to $100,000 for 10-25% of teen businesses and provide valuable mentorship and industry connections.

- Crowdfunding platforms like Kickstarter and Indiegogo let teens keep full control of their business while raising money from many small donations worldwide.

- Programs like the Amber Grant give monthly cash awards and a yearly $25,000 prize to support young female entrepreneurs starting their own businesses.

Personal Savings

Personal savings is the most direct way to fund your teen business dreams. Start by setting aside money from part-time jobs, allowances or birthday gifts into a business account.

Smart budgeting helps you track every dollar and builds a solid foundation for your startup capital.

Your own money gives you full control over your business decisions without owing anyone else. Most successful teen entrepreneurs start small with their savings and grow steadily by reinvesting profits back into their business.

This might take longer but teaches you important money management skills and keeps you debt free. Plus using your own funds shows future investors you are serious about financial responsibility.

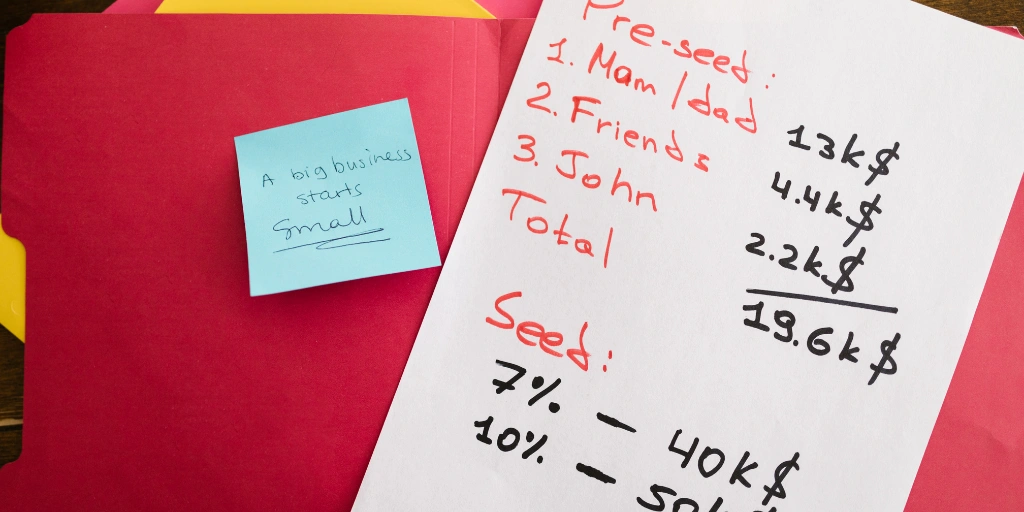

Family and Friends

Family and friends make great first investors for teen business ideas. They offer more flexible payment terms and lower interest rates than banks. Most teens start with small amounts from parents, siblings or close relatives who believe in their goals.

These loans come with less pressure and paperwork than traditional funding sources.

Money from loved ones need clear agreements to avoid future problems. Smart teen entrepreneurs write down all loan details – including payment schedules and interest rates. They treat these personal loans like real business deals.

This keeps relationships strong while building good financial habits. Many successful business owners started with $500 to $5,000 from their family circle. The key is to stay professional and honest about business progress with these personal investors.

Crowdfunding Platforms

Crowdfunding platforms like Kickstarter and Indiegogo give teen entrepreneurs a chance to share their ideas with the world. These online platforms let you present your business concept through videos, photos and text to attract backers.

Success depends on creating an awesome pitch that grabs attention. Smart marketing helps spread the word about your campaign across social media and other channels.

Money flows from many small donations instead of one big investor. Most platforms work on an all-or-nothing model – you must hit your funding target to get any money. This forces you to set realistic goals and work hard to reach them.

The best part? You keep full control of your business while gaining valuable feedback from backers who believe in your idea. Plus running a campaign teaches real-world skills in project planning, marketing and communication.

Angel Investors

Angel investors offer more than just money for teen entrepreneurs. These wealthy people put their own money into startups in exchange for part ownership. They bring valuable business experience and connections to help young founders grow their business.Most angel investors want to see a clear business plan that shows how they’ll make money back. They often invest between $25,000 to $100,000 for 10-25% of the business.

Smart teens need to pick their angel investors wisely. The right investor is like a mentor and opens doors to new opportunities. Many successful tech companies started with angel funding – just look at Facebook’s early days.

The trade-off is giving up some control of your business decisions. Still, having an experienced business person guide you through tough choices can make the difference between success and failure.

Angel investors typically want regular updates on the company’s progress and may join the board of directors.

Government Grants and Programs

Government grants offer young entrepreneurs free money to start their dreams. The Small Business Administration (SBA) has a Youth Entrepreneurship Program that gives both cash and guidance to young business owners.

These grants target specific areas like tech, health and education startups. Many teens skip these options because they think the process looks hard but it’s not.

The best part? You don’t give up any ownership of your company.

The application needs a solid business plan and clear financial goals. You’ll need to show how you’ll use the money and track your progress. Government programs also give free business training and mentoring.

This extra support helps teens turn their ideas into real companies. The SBA website lists all current grant options and deadlines for young founders.

Business Competitions and Awards

Business competitions offer teen entrepreneurs amazing chances to win money and gain exposure. Major contests like the FedEx Small Business Grant Contest give cash prizes to young business owners across different industries.

Female teen entrepreneurs should check out the Amber Grant program. It gives out monthly cash awards and a big $25,000 prize at the end of each year.

These competitions do more than just hand out money – they push teens to polish their business plans and pitch skills.You can use the prize money to fund your business and best of all, none of these contests check credit score or prior business experience.

TechDev Entrepreneurship Olympiad

At TechDev Academy, we support young entrepreneurs by providing both mentorship and funding through our Entrepreneurship Olympiad, specifically designed for 8th to 12th graders. Our goal is to inspire and nurture future CEOs at an early stage. If you’re a high school student, don’t miss this incredible opportunity!

Venture Capital for Young Entrepreneurs

Venture capital firms are now open to teen entrepreneurs with game changing ideas. They invest in startups that show massive growth potential. They look for fresh business models that can scale fast and bring big returns.

Teen entrepreneurs need a solid pitch to get VC attention. Your business plan must show clear financials and market research. Most VCs want a stake in your company – usually 20% to 30% equity – in exchange for their cash.

They also bring valuable mentorship, industry connections and expert guidance to help scale your startup. Many successful tech companies like Snapchat started with venture capital while their founders were still in their teens.

Business Incubators and Accelerators

Business incubators are the place to be for young entrepreneurs to start. These programs give teens office space, mentors and business tools for cheap.

Most incubators help new businesses grow roots step by step. They teach basic business skills, help create business plans and connect teens with expert advisors.

The best part? Many incubators are partnered with local schools and colleges so they’re easy to find and join.

Accelerators go a different route by speeding up business growth through intense programs. These programs pack months of learning into weeks, pushing teen entrepreneurs to think bigger and move faster.

Top accelerators offer seed money, connect teens with successful business leaders and help polish business pitches. Many tech startups got their big break from an accelerator program.

The programs end with a demo day where teens present their ideas to potential investors. This setup helps young business owners build confidence and get real world experience while growing their company.

Partnerships and Sponsorships

Partnerships and sponsorships open doors for teen entrepreneurs to access funding and resources. Local companies partner with young business owners who share their values or target the same customers.

These partnerships can be cash, free supplies or valuable mentoring from experienced professionals. Many successful teen startups grew from smart partnerships with established brands.

Local business groups and organizations are ready to help teen entrepreneurs succeed. They offer financial aid packages, training programs and expert guidance to young business owners.

Some groups focus on specific industries or communities so it’s easier to find the right match. Teen entrepreneurs can tap into these networks to build long term relationships with potential sponsors and partners.

Other Funding Options

Teen entrepreneurs can fund their business dreams in creative ways. Smart money moves start with thinking outside the box.

- Trade your skills or products with other businesses to save cash. A young web designer might build a website in exchange for office space.

- Sell pre-orders of your product to test market interest and raise startup funds. Your future customers become early investors in your success.

- Microfinance institutions offer smaller loans with easier terms than big banks. These loans are usually $500 to $5,000 for young business owners.

- Invoice financing lets you get paid faster by selling your unpaid customer bills. You’ll get most of your money right away instead of waiting 30-90 days.

- Partner with established brands through sponsorship deals. Local businesses often support teen entrepreneurs with cash or resources.

- Check out peer-to-peer lending platforms that connect you with individual investors. These platforms often have better interest rates than traditional loans.

- Set up a subscription model where customers pay monthly for your service. This gives you steady cash flow to fund your growth.

- Barter goods or services within your local business community. This saves you money while building valuable business relationships.

- Look into merchant cash advances based on your future credit card sales. This works well for retail or food service businesses.

- Create a membership program with special perks for early supporters. Members get exclusive products or services in return for their investment.

Conclusion

Money is available for teen business dreams. From personal savings to crowdfunding platforms, young go-getters can tap into many funding sources. Smart teens mix different funding options to build their business success.

Your next big idea deserves the right financial backing – pick the method that fits your goals and start your business today.

FAQs

- What funding options are available for teen entrepreneurs?

- How can teens use crowdfunding to start a business?

- Are bank loans possible for teen entrepreneurs?

- What about angel investors for teen startups?

- How important is a business plan for funding?

- Can teens get government grants for their business?

Teen entrepreneurs can get money through personal savings, bank loans, government grants, crowdfunding platforms and angel investors. Some teens also use peer-to-peer lending or ask friends and family for startup capital.

Teens can create crowdfunding campaigns on popular platforms to share their business ideas. They need a clear marketing strategy, good communications and a target audience. Rewards-based crowdfunding works well for creative projects.

Yes, but you need an adult co-signer due to age limits. Banks will evaluate creditworthiness and want to see a solid business plan with financial projections. Fixed interest rates and clear repayment terms are important.

Angel investors invest equity in start-ups with high growth potential. They bring business experience and can help with project management. They expect a good return on investment.

Business plan is required for any funding request. It should show revenue generation plans, marketing strategies and competitive landscape details. This will motivate potential investors and prove financial responsibility.

Yes, many government grants exist for young entrepreneurs. These don’t require repayment like business loans. Microfinance institutions also have programs for teen-led sustainable business ideas.